real estate asset classes uk

Our first edition of the 2022 Real Estate Outlook saw few signs of the economy slowing. Citizens of the UK are the most likely in the world.

Job in London - England - UK EC1A.

. For each asset class in bold I will provide a brief explanation of the risks the rewards the liquidity characteristics and give an indication of an appropriate minimum time horizon to hold each investment. Lets start with the one that many people understand best. Property investment continues to play a huge role in sustaining the economy of the United Kingdom.

Real estate or other tangible assets Real estate and other physical assets are considered an asset class that offers protection against inflation. Their appeal is supported by sound demographic. These are referred to as asset classes.

However during periods of stagflation real estate returned 55 in real terms while equities returned 25 and government bonds -73. Tim Clark Bisnow UK and Dublin London Other. Ad Reap the benefits from joining one of the largest online real estate investing platforms.

The tangible nature of such assets also leads to them being considered. The Established sectors such as offices logistics retail residential affordable and student housing stand to benefit most from this influx of capital in the coming years. When it comes to existing and emerging asset classes in the Real Estate sector there have been some clear winners and losers resulting from the events of the last year.

We are property investors and global solutions providers across the full range of real estate asset classes. For instance the ECB balance sheet has risen to the highest level in its history and with it the long-term inflation risk. We expect a deteriorating performance for office and a gradual strengthening in retail performance through 2022.

Financial Analyst Portfolio Manager Real Estate Asset Manager. 23 September 2021. Real estate asset classes provide a wide range of potential opportunities for investors.

Hayden examines the market shift towards alternative asset classes that promise more attractive returns but. Co-working offices offer a more flexible solution to freelancers entrepreneurs and organizations compared to traditional office spaces. Browse discover thousands of brands.

Schroders range of responsible investment funds could help investors maximise their investment returns using an ethical approach in compliance with the UN Principles for Responsible Investment. Unlike regularly priced stocks and bonds real assets are more illiquid and opaque and have inherent physical worth. Arguably the pandemic has simply acted as a catalyst for changes anticipated by many for some time but doubtless it has played to the strengths and preyed on the weaknesses of particular uses on an extreme.

Its main rival bonds have become less attractive. Start Your Learning Journey From The Comfort Of Your Own Home Today With Reedcouk. The commercial real estate market is divided into six primary asset classes.

As you learn how to invest in real estate you should understand your options in the real estate market. We are a commercial real estate lender focused on middle-market loans throughout Europe and the United Kingdom. Cash Money markets.

Get unlimited access to online investment opportunities with CrowdStreet. For example you can invest in commercial real estate or residential property types to diversify your portfolio. Since 1978 annual real after inflation total returns were of 6-7 during times of balanced economy with a median of 69.

Core course units are shared with our MSc Real Estate. Real estate market cap in the UK 2020 by asset class. MSc Real Estate Asset Management is a fast-track conversion course that will allow you to gain the necessary framework of knowledge understanding and skills to enable you to pursue a successful career in real estate asset management in the UK or internationally.

Whether you want to invest in specific geographical areas developmental stages property types or property classes In the end your real estate investment strategy should be directed by what makes the most sense for your wallet and your specific. But information available can be either incorrect or difficult to understand. Additionally two common alternative asset classes are commodities and as you may have guessed real estate.

Listed below are six of the hottest alternative real estate asset classes which are gaining attention from institutional investors worldwide. Corporate earnings were healthy employment was reaching pre-pandemic levels reasonable wage growth was present and the supply chain issues. Three traditional asset classes are equities or stocks cash equivalents or a Money Market and fixed income or bonds.

They are the most accessible asset classes and continue to attract the largest proportion of investment dollars in the UK. It is precisely these dark clouds over the economy and financial markets that could make the real estate asset class shine all the brighter. Office residential hospitality industrial and retail as well as niche assets.

Whether youre a budding real estate investor or just curious to learn more about investing heres a crash course on real estate asset classes versus property types and what. Ill also point out some of the key sub-asset classes which exist and how they differ. Residential office industrial retail and hospitality.

Investing in real estate is a great way to diversify your portfolioBut before you invest in real estate understanding real estate asset classes is important. As an investment asset class real assets encompass tangible assets such as real estate and infrastructure. The asset class of equities is often subdivided by market capitalization into small-cap mid-cap and large-cap stocks.

Commercial Real Estate Real Estate Asset Manager. Within each asset class properties will be graded by quality ie. Schroders managed real estate expertise stretches back to 1971 and since then has been consistently recognised by the real estate industry for its outstanding performance.

Ad Enjoy low prices on earths biggest selection of books electronics home apparel more. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Ad Discover Award-Winning Diplomas Courses Within Your Budget At Reedcouk.

There are four main investment categories into which most of our money is invested. Understanding the difference between the real estate asset classes and property types is key for investors in the space. In this video Hayden Cameron Partner discusses the key trends developing in the UK real estate market and considers future legal changes that will have a material ongoing impact on real estate investment in the UK.

Class A B C etc driven largely by age and upkeep as well as sub-divided by business plan eg. In our view the biggest threats to real estate markets are periods of. Schroders real estate fund managers now have 213 billion of gross real estate assets under management in a broad range of liquid open and closed-ended funds.

Asset classes in real estate are better understood if you think of them as alternative assets that fall into a. With a discount to net asset value as of 31 March 2022 of 224 and 233 for Continental Europe and the UK respectively real estate securities are trading near the lowest levels in a decade. Within residential there are multifamily.

According to a recent survey approximately one-third of UK adults agree that property will be the best performing asset in 2022 with investors favouring it over stocks cash and cryptocurrency. The co-working office owner or operator. We acquire recapitalize refinance and develop real estate and we invest in sector-related operating businesses.

With a rich history of bringing clarity and consistency to the complex MSCI is well placed to drive industry. As of June 2020 listed office real estate companies had a market capitalization of 666 billion euros while multifamily housing companies. Read customer reviews find best sellers.

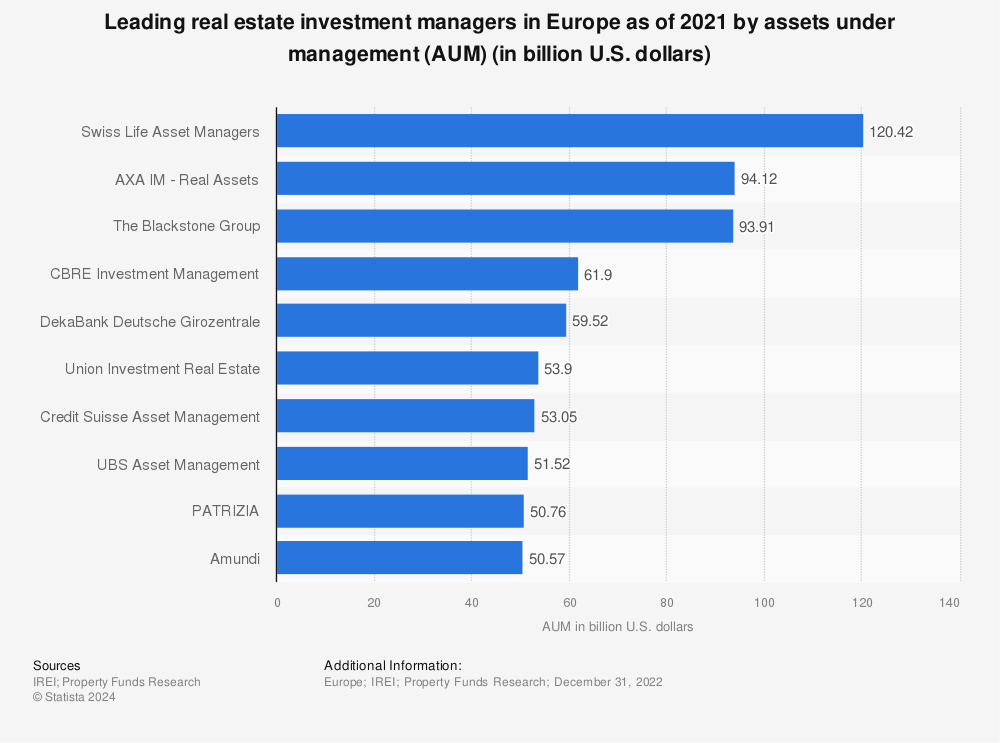

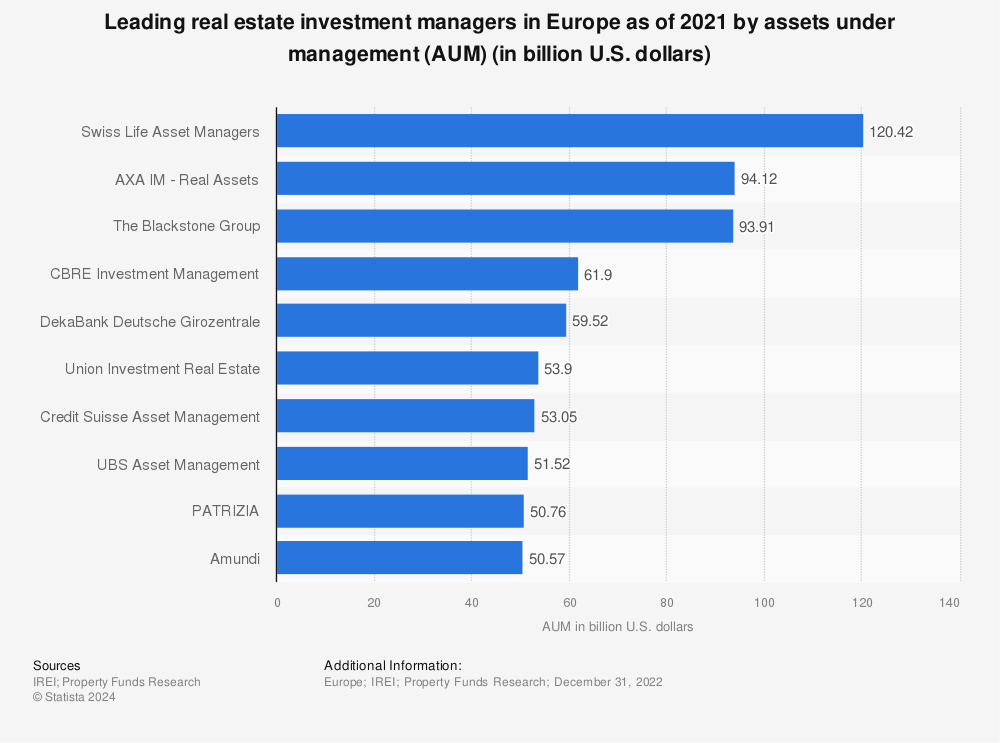

Leading Real Estate Investment Managers By Aum Europe Statista

Real Estate Joint Ventures Marriage Of Equity And Expertise White Case Llp

All About Asset Classes And Investment Diversification The Motley Fool

Inflation Investments What Asset Classes Do Well In Inflation

:max_bytes(150000):strip_icc()/dotdash_FINAL_Diversification_Its_All_About_Asset_Class_Jan_2020-fe0eea99d53d4883824b1859f899627c.jpg)

Diversification It S All About Asset Class

6 Key Alternative Real Estate Asset Classes The Fintech Way

/real-estate-investing-101-357985-final-5bdb4da04cedfd0026ac6b3f.png)

Real Estate Investing Tips For Beginners

Canadian Real Estate Vs The Stock Market Rbc Wealth Management

Understanding The Real Estate Asset Class Property Types And Property Classes 2022 Bungalow

How To Invest In Reits In The Uk Raisin Uk

Asset Classes Views Keeping Up With Climate Change Amundi Research Center

Real Estate Private Equity Overview Careers Salaries Interviews

Inflation Investments What Asset Classes Do Well In Inflation

Asset Classes Views Keeping Up With Climate Change Amundi Research Center

Real Estate Joint Ventures Marriage Of Equity And Expertise White Case Llp

How To Invest In Reits In The Uk Raisin Uk

Real Estate Joint Ventures Marriage Of Equity And Expertise White Case Llp